does texas have an inheritance tax 2019

There are no inheritance. The federal government of the United States does have an estate tax.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

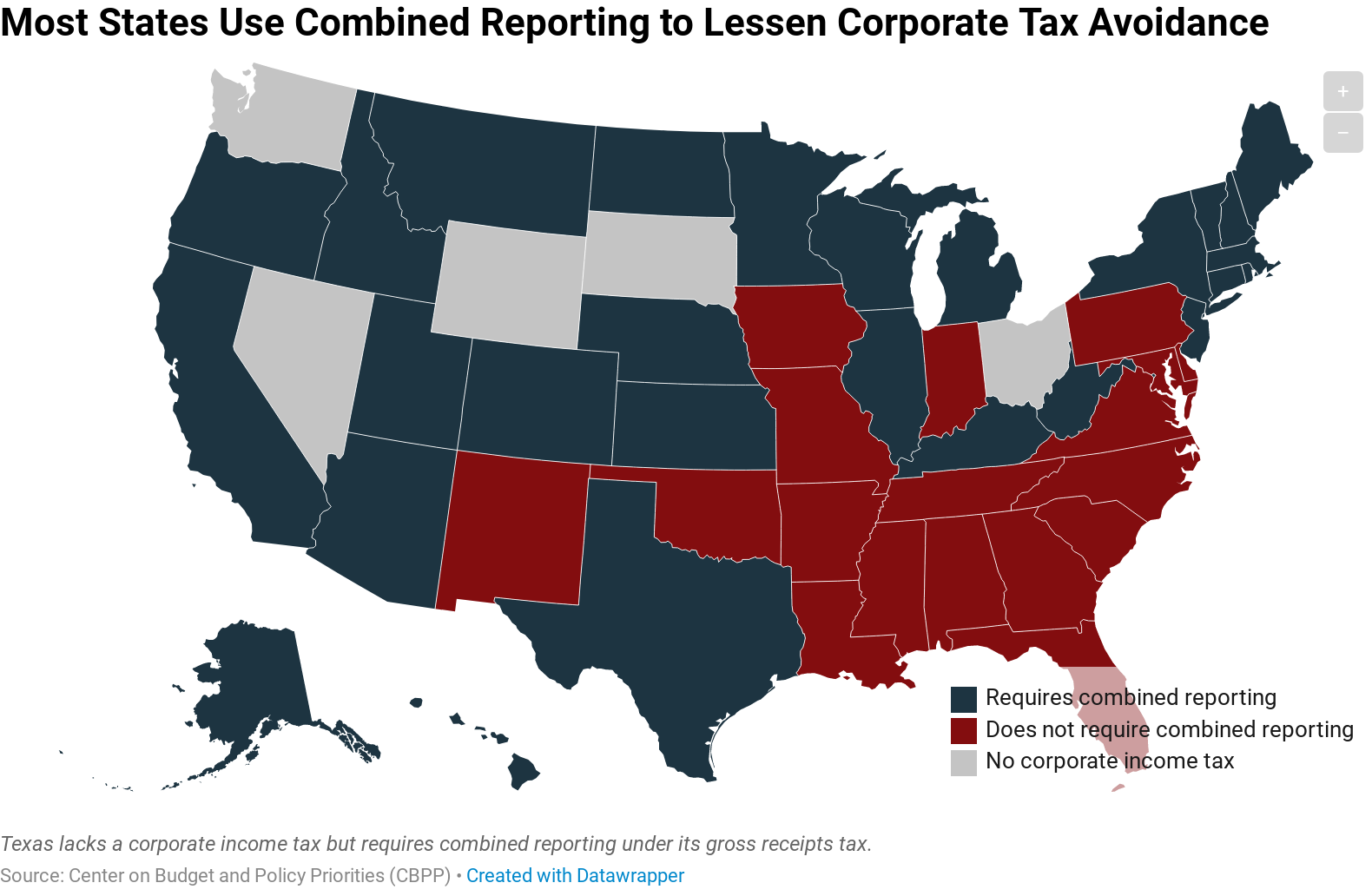

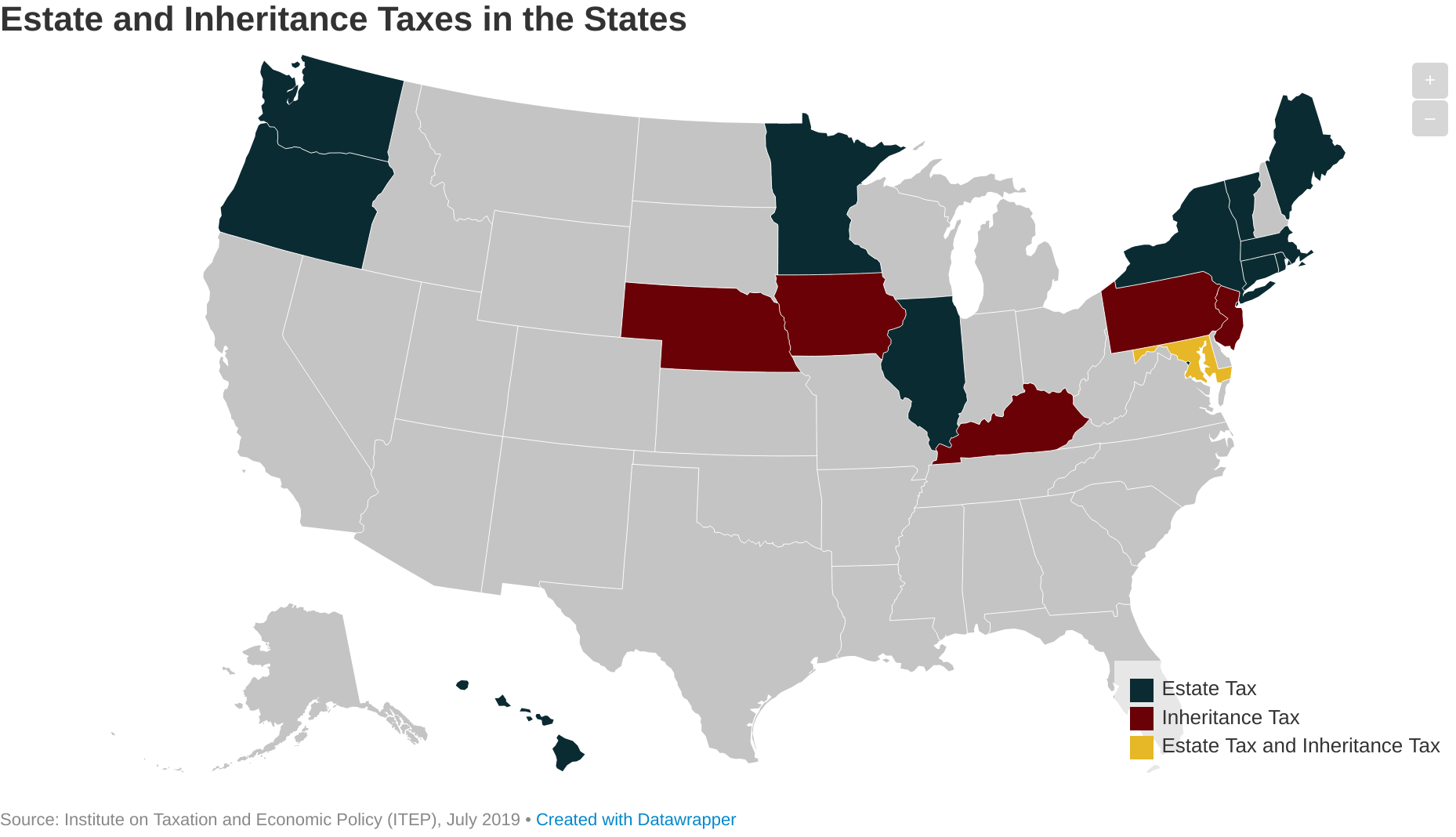

In addition to the federal estate tax of 40 percent some states impose an additional estate or inheritance tax.

. The Texas Franchise Tax. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. For 2021 the IRS estate tax exemption is 117 million per individual which means that a.

These states have an inheritance tax. New York raised its exemption level to 525 million this year and will match the federal exemption level by 2019. Does Texas Recognize Domestic Partnership In 2019.

You are required to file a state business income tax return in. This includes children who were adopted as adults. However localities can levy sales taxes which can reach 75.

Texas Inheritance Tax and Gift Tax. In 2011 estates are exempt from paying taxes on the first 5 million in assets. Higher rates are found in locations that lack a property tax.

Surviving spouses are always exempt. The state also has ruled that adopted children have the same inheritance rights as biological children. The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow.

As of 2021 the six states that charge an inheritance tax. The state of Texas is not one of these states. His assets were held in a living trust that became an irrevocable trust upon his death.

A federal estate tax is a tax that is levied by the federal government and that is based on the net value of the decedents estate. Estates over that amount must pay estate tax on the amount not covered by the exemption and how big the estate is determines what. Does Texas Have an Inheritance Tax or Estate Tax.

The rate increases to 075 for other non-exempt businesses. These states have an inheritance tax. The state business return is not available in TurboTax.

Massachusetts has the lowest exemption level at 1 million and DC. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Biological children have strong inheritance rights in the state of Texas.

Its paid by the estate and not the heirs although it could reduce the value of their inheritance. All six states exempt spouses and some fully or partially exempt immediate relatives. See where your state shows up on the board.

As of 2019 only twelve states collect an inheritance tax. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. Understanding how Texas estate tax laws apply to your particular situation is critical.

Some states have inheritance tax some have estate tax some have both some have none at all. Alaska is one of five states with no state sales tax. When someone dies their estate goes through a legal process known as probate.

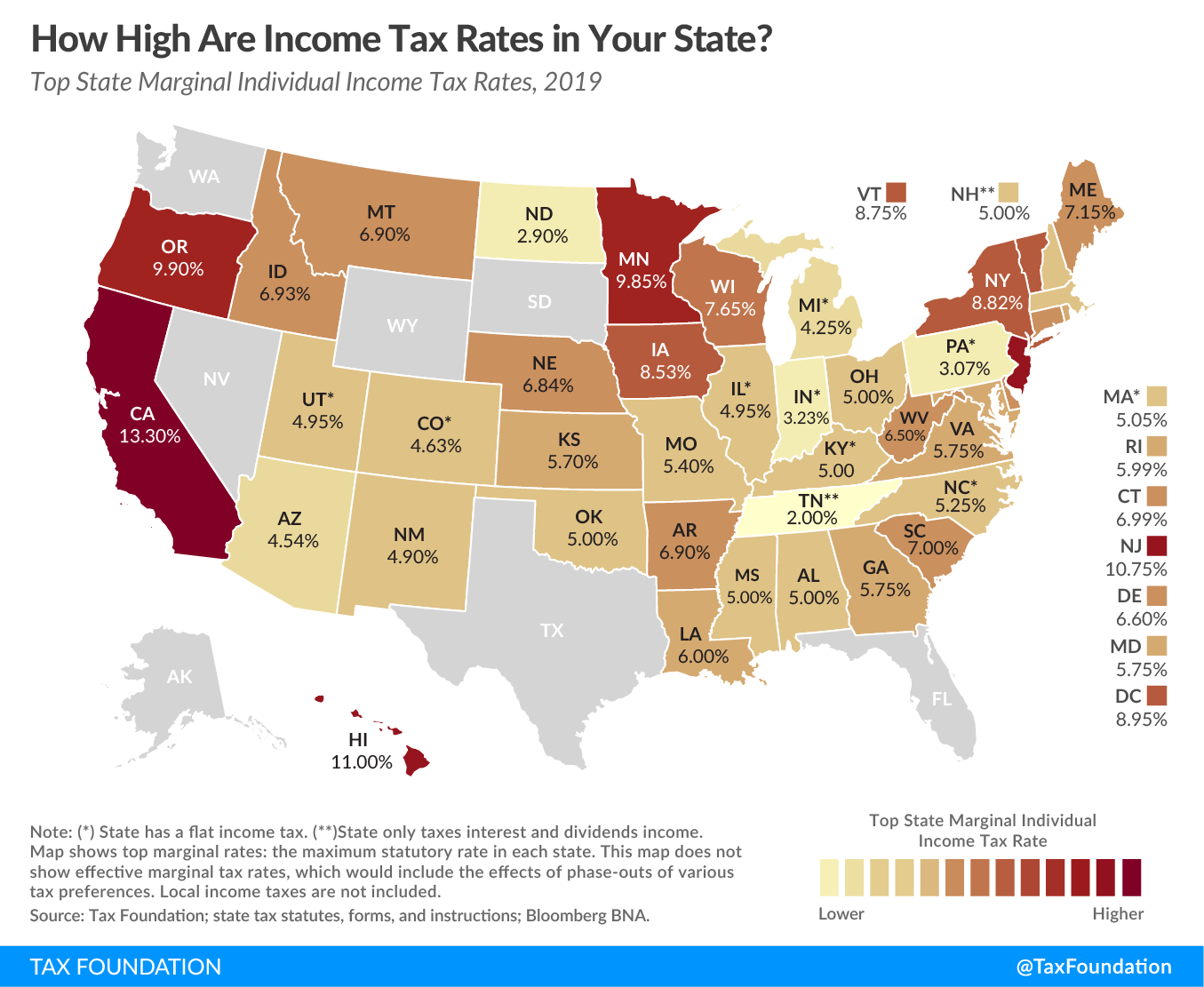

These numbers are current as of 2019. Because the state is free of inheritance tax heirs to an inheritance wont be taxed on it. States that currently impose an inheritance tax include.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. For deaths in 2021-2024 some inheritors will still have to pay a reduced inheritance tax Kentucky. Prior to september 15 2015 the tax was tied to the federal state death tax credit.

As of 2021 the six states that charge an inheritance tax are. Iowa but Iowa is in the process of phasing out its inheritance tax which was repealed in 2021. As noted only the wealthiest estates are subject to this tax.

Has the highest exemption level at 568 million. Up to 25 cash back Who Pays State Inheritance Tax. Near the end of the interview procedure TurboTax stated.

There is a 40 percent federal tax however on. State inheritance tax rates range from 1 up to 16. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold.

2 An estate tax is a tax on the value of the decedents property. The estate tax is different from the inheritance tax which is taken by the government after money or possessions have been passed on to the deceased persons heirs. Inheritance tax rates differ by the state.

An inheritance tax is a tax on the property you receive from the decedent. However this is only levied against estates worth more than 117 million. So only very large estates would ever need to worry about this tax becoming an issue.

There is also no inheritance tax in Texas. However other states inheritance taxes may apply to you if a loved one who lives in those states. The state repealed the inheritance tax beginning on 9115.

Be aware of the 15000 federal gift tax which allows you to make an annual gift of up to 15000 without taxes. Additionally they may have to pay additional federal or state taxes. Does Texas Recognize.

These federal estate taxes are paid by the estate itself. Texas repealed its inheritance tax law in 2015 but other tricky rules can apply depending on what you do with the money or property. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Similarly the federal estate tax allows an deceased person to transfer assets up to 112 million dollars tax free. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

Currently there is no federal estate tax upto 1158 million in the year 2020The estate tax exemption limit for year 2019 is 114 million It should be noted that since the the estate tax exemption limit is per person a married couple can claim double of it. Maryland imposes the lowest top rate at 10 percent. The 1041 federal return was for the estate of my father who died in the middle of 2018.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Fourteen states and the District of Columbia impose an estate tax while six states have an inheritance tax. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

If you do not make a will prior to your death according to the sucession plan of the state of Texas stepchildren. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and.

Texas Estate Tax Everything You Need To Know Smartasset

States With Highest And Lowest Sales Tax Rates

Recent Changes To Estate Tax Law What S New For 2019

Here S Which States Collect Zero Estate Or Inheritance Taxes

Us State Tax Planning Gfm Asset Management

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Inheritance Tax Debate What The Wealthy Need To Know Asia Newsday

Inheritance Tax Texas How To Discuss

Taxes For Beneficiaries In Texas Silberman Law Firm Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

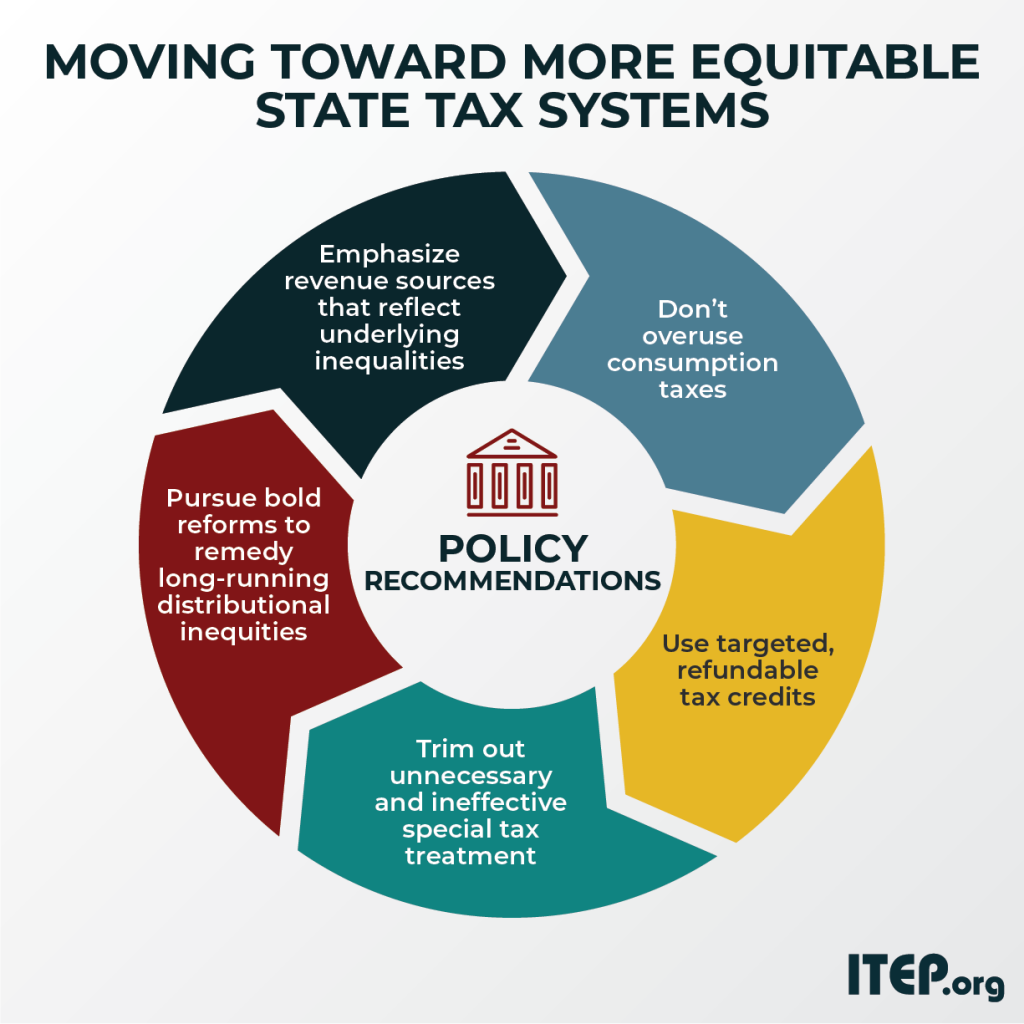

Moving Toward More Equitable State Tax Systems Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Inheritance And Estate Taxes Ibekwe Law

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi